Monthly Housing Market Update

Highlights:

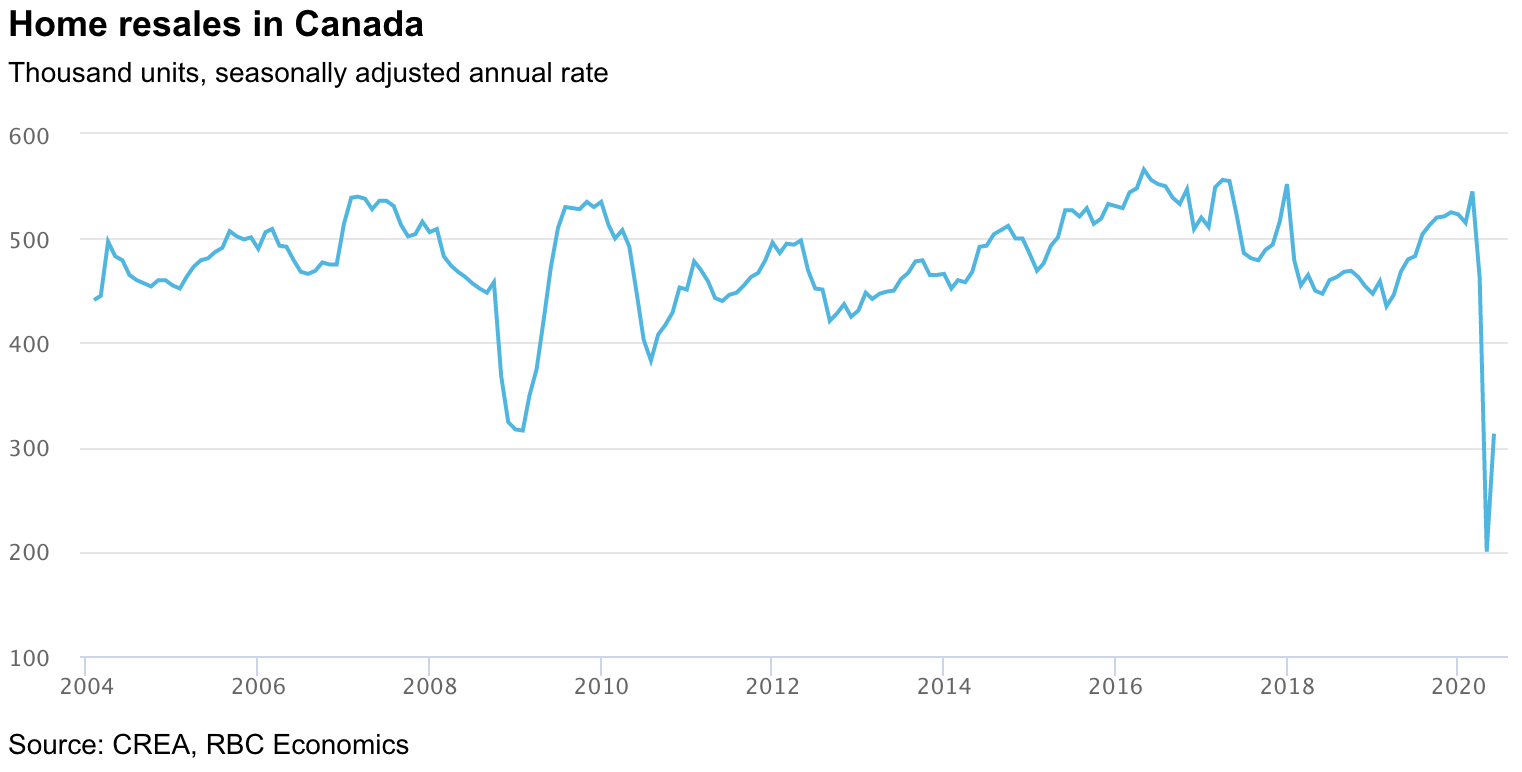

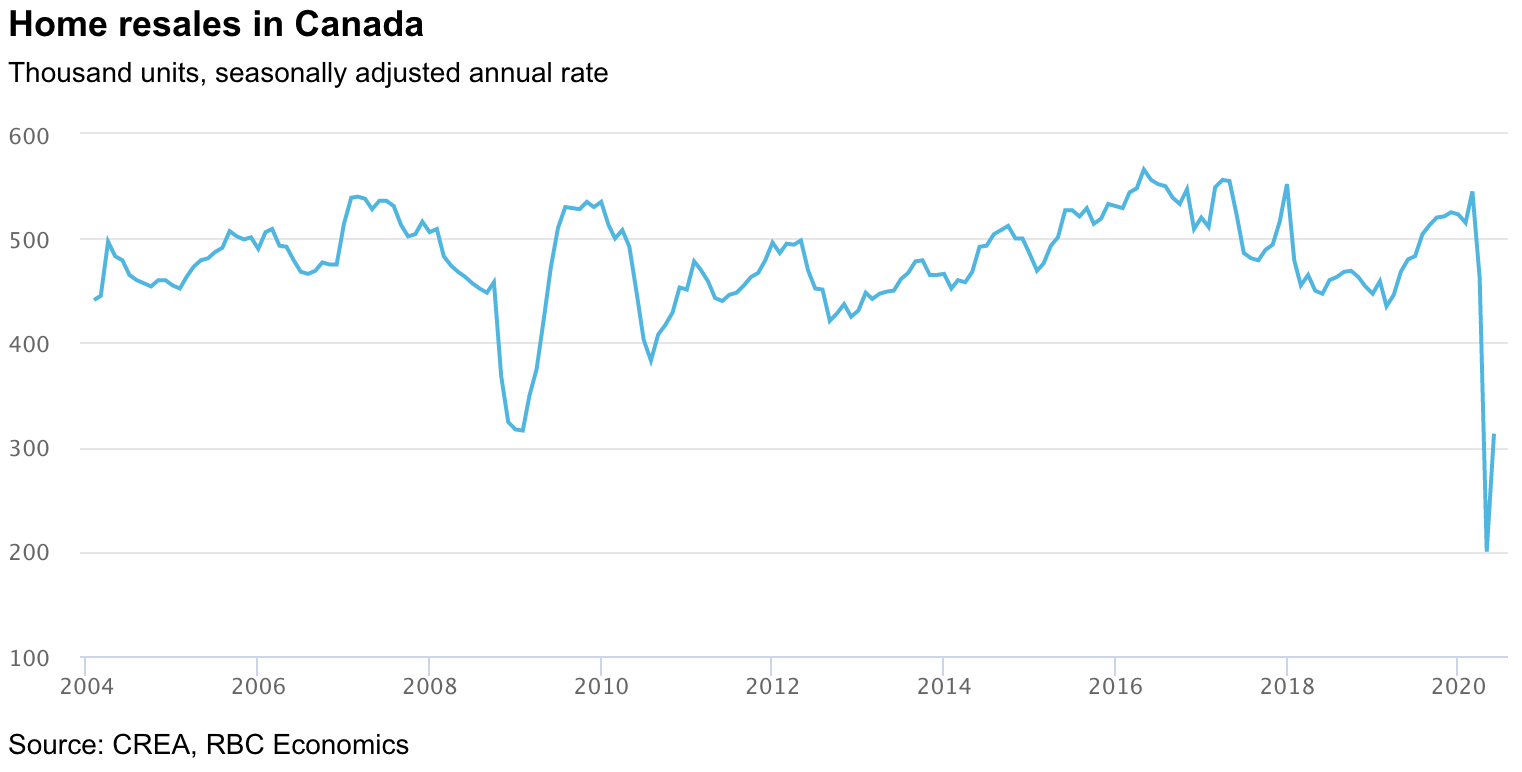

- Home resales reversed one-third of the March-April drop: The gradual reopening of the economy across Canada set the stage for activity to rise 57% from a generational low in April. All major markets recorded monthly increases ranging between 40% and more than 90%. Still, the 313,000 units sold (seasonally-adjusted and annualized) nationwide represented the second-lowest level since early-1999.

- Sellers made their move after holding off for nearly two months: New listings surged 69% in May from April’s low point. This contributed to ease demand-supply conditions that had remained particularly tight since the onset of COVID-19.

- Prices cresting: The level of Canadian Real Estate Association’s Home Price Index was effectively flat compared to April. The annual rate of increase in the index inched down to 5.4% in May from 5.6% in April. We expect further broad-based weakening in the period ahead.

- Rising supply will erode price support: The delay in spring listings will likely boost supply during the summer at a time when homebuyer demand will still be soft—albeit recovering. The eventual winding down of financial support programs is also poised to bring more supply to market later this year.

- Number of transactions will recover only gradually and unevenly: The severe economic shock of COVID-19 will upset many Canadians’ plan to own a home for some time to come. This will be especially the case in oil-producing regions of the country where high unemployment will weigh heavily on housing demand.

Percentage changes impressive but overstate May’s rebound

The jump in home resales last month wasn’t a surprise given the earlier plummet—to a 36-year low in April—had much to do with the unprecedented lockdowns and social distancing orders imposed since mid-March. It was clear the lifting of some of these measures in May would kick the market into gear. Yet the eye-catching month-to-month gains across the country overstate the rebound. Activity was still 40% to more than 50% below year-ago levels in most major markets. The increase in May made up only one-fifth of the drop in March and April in Vancouver and Toronto, and closer to one-quarter in Ottawa. Markets in Saskatchewan and Manitoba were further ahead in the recovery—sales reversing 50% to almost 85% of the declines in the previous two months—reflecting the relatively speedier reopening of the economy in these provinces.

May Market Snapshot

Resales have more (albeit limited) room to recover near term

We expect to see more buyers returning to the market this summer as they become more comfortable house hunting amid falling infection rates and as provincial governments continue to relax social distancing restrictions. That said, we expect that many won’t return due to COVID-19 and the collapse in oil prices. Slower immigration will also be a dampening factor keeping housing demand soft, especially in oil-producing regions.

Supply starting to decouple from demand

There are early signs demand and supply are decoupling. After falling in tandem in March and April, supply rose faster than demand in May. The 69% m/m surge in new listings brought the Canada-wide sales-to-new listings ratio down to 0.59 from 0.63 in April. The ratio fell in the majority of markets outside Ontario with Montreal and other Quebec markets posting large declines (though from generally elevated levels). New listings tripled in May in Montreal after the provincial government lifted the lockdown it imposed on the real estate industry mid-March. New listings rose more modestly in most Ontario markets last month, further tightening demand-supply conditions in the province.

The story to watch going forward: supply

We expect further decoupling in the period ahead. Economic hardship is no doubt taking a toll on a number of current homeowners—including investors. Some of them could be running out of options once government support programs and mortgage payment deferrals end, and may be compelled to sell their property.

Market balance to erode

Despite easing in May, demand-supply conditions generally remained balanced across Canada or still favoured sellers. That’s likely to change. We expect the increase in supply to tip the scale in favour of buyers in many markets across Canada, some sooner than others. Vancouver and other BC markets, for example, could see buyers calling the shots as early as this summer. It could take a little longer in Ontario, Quebec and parts of the Atlantic Provinces. Buyers already rule in Alberta and Newfoundland and Labrador.

Downward price pressure to build

Canada’s HPI has likely crested. We believe downward price pressure will build in most markets in the coming months. Strong starting points in Ottawa, Montreal, Toronto and Halifax will provide these markets with a temporary buffer. Prices are already declining in Alberta, and Newfoundland and Labrador. Nationwide, we expect benchmark prices to fall 7% by the middle of 2021 though believe a widespread collapse in property values is unlikely.